They DeclineWe ApproveApply now!

We support high risk merchants with competitive rates on credit card processing and alternative payment processing options.

Over 1K+ Active User's

Collaborating with over 1000+ companies around the world

Merchant Accounts & Payment Gateway

Credit Card Processing

Apply for an Merchant Account to accept credit card payments online and by phone or mail order. We offer extremely low rates on Retail and High Risk Merchant Accounts to save your money on Credit Card Processing!

We can provide merchant accounts for new businesses or, if you already accept credit cards, we’ll show you how much you can save by switching from your existing provider to a BridgeSwipe.

Apply Online

Quick application form with your business details—no lengthy paperwork required.

Get Approved

Our team reviews your business profile and conducts a fast, secure risk assessment.

Start Processing

Once approved, activate your merchant account and begin accepting payments.

Key Features

Take Your Business to the Next Level

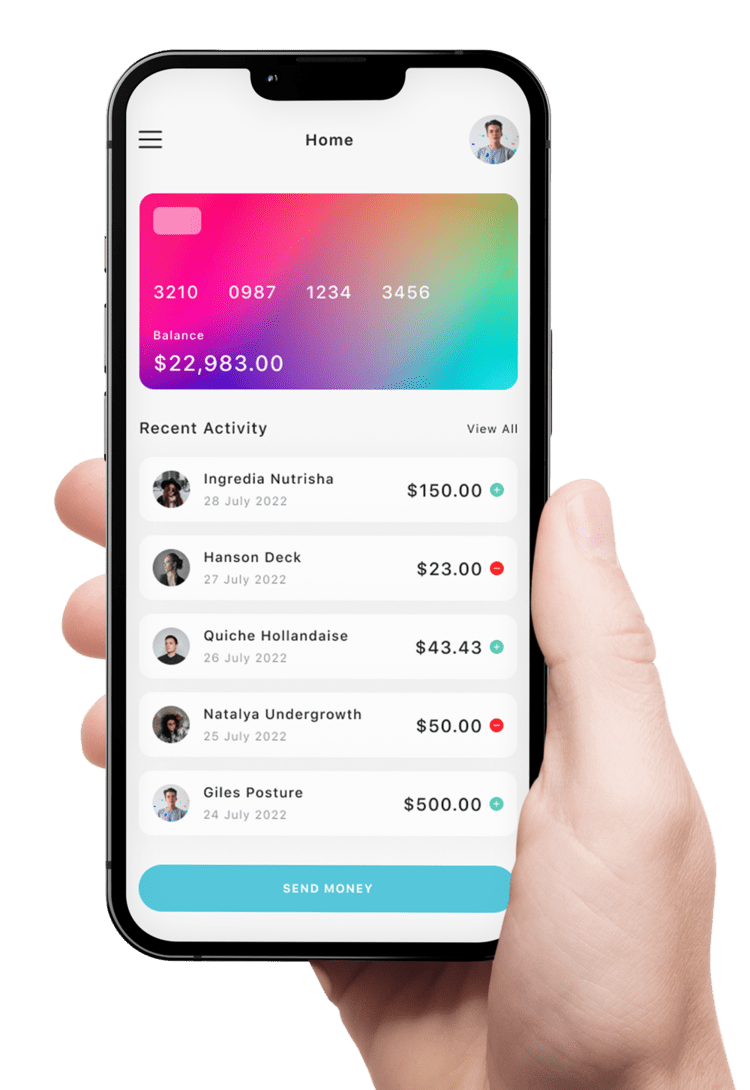

Payment Gateway

Easily accept payments online with our secure gateway. Enjoy fast transactions, advanced fraud protection, and support for all major payment methods.

Chargeback Prevention

Protect your business with smart chargeback prevention. Our solutions help detect risky transactions and minimize losses from disputes.

High Risk Merchant A/c

Get approved for high-risk merchant accounts quickly. We offer secure processing, fraud management, and expert support for your business needs.

Business Loans & Leasing

Empower your business with flexible loans and leasing options. Access quick funding to expand operations or upgrade your equipment.

International Payments

Expand globally with hassle-free international payments. Benefit from great exchange rates, low fees, and reliable transfers worldwide.

Retail Merchant Accounts

Simplify in-store payments with our retail merchant accounts. Enjoy fast settlements, secure transactions, and easy POS integration.

Authentic Payment Processor That You Can Find

High Risk Merchant & Payment Processing

We offer streamlined payment processing that ensures quick and hassle-free transactions for your customers, enhancing their shopping experience while boosting your conversion rates.

Accept various payment methods including credit cards, debit cards, ACH transfers, and alternative payment options to accommodate all your customers’ preferences.

4.9/5.0 Trusted by High-Risk Merchants

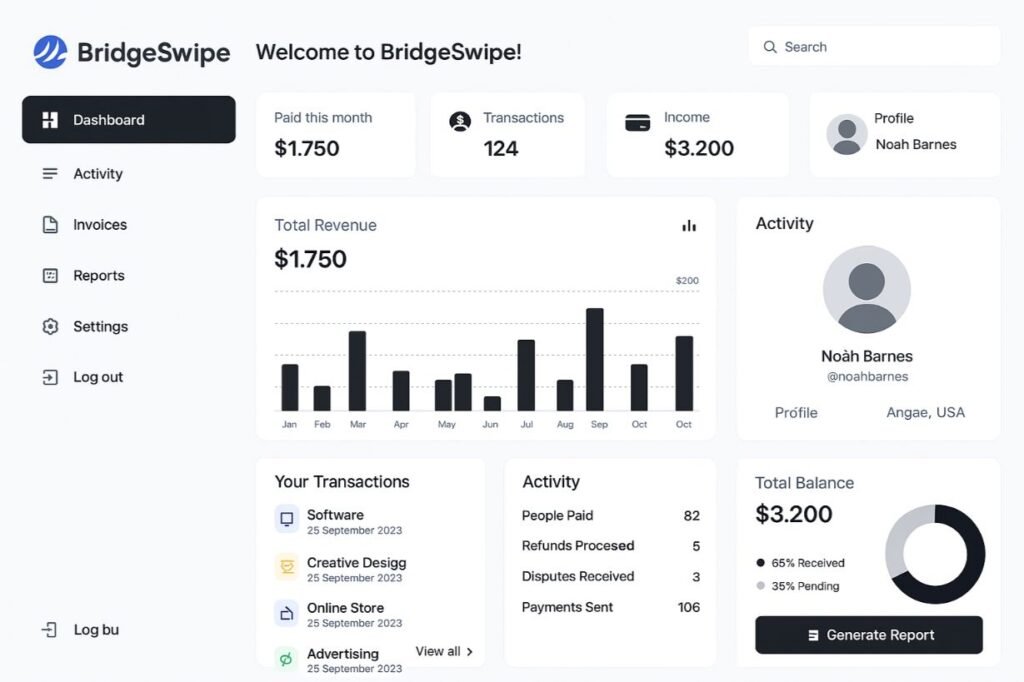

Our Product

Seamless Online Payments

Connect your website with our low-cost Internet Payment Gateway. Supported by over 100 popular shopping carts and packed with advanced features.

Business Loans & Equipment Leasing

Need financing for your business? Our direct lenders offer numerous financing options including business loans based on cash flow, not credit score. Get approved even if banks have declined you.

BridgeSwipe’s smart underwriting tools analyze your transaction history and recommend loan or lease amounts tailored to your monthly revenue. No guessing, no overborrowing—just financing that fits.

Stay on top of your commitments effortlessly. Our automated ACH system ensures timely repayments with zero manual input—saving you time, late fees, and stress.

Never miss a beat. Enable intelligent alerts to track your upcoming payments, funding status, or new offers—all in real time via email or SMS.

Advanced Payment Solutions

Connect your existing merchant account to your website or ecommerce store with bridgeSwipe’s full function low cost Internet Payment Gateway which is supported by more than 100 popular shopping carts.

Internet Merchant Accounts

An Internet Merchant Account is sometimes referred to as a “MOTO” (Mail Order & Telephone Order) Account because they all require the ability to process a credit card payment when there is no physical credit card present to be swiped.

High Risk Merchant Accounts

If the domestic banks are denying your merchant application because they believe your industry is considered high risk, BridgeSwipe can help! We have an offshore network of merchant processing partners that enable us to provide low cost, high risk merchant solutions to a much wider range of businesses and industries.

Testimonials

Positive Reviews From Our Users

Super Fast Approvals!

Smooth onboarding and fast approvals! Made it easy to get started with my high-risk business.

Linda Watson

Janet Lawson

Freelancer

Don't need to worry about payment!

If you run a high-risk business, you won’t find a better payment solution—BridgeSwipe made everything stress-free.

Marsha Ginger

Seamless Payment Processing

The signup process was simple, and I was accepting payments on my website almost immediately. Highly recommended!

Mikes Brown

Great Support Team

Customer service is always responsive and friendly, answering my questions whenever I need help—day or night.

Pepper Jhonson

Winston Papps

Freelancer

Thomas Jacks

Freelancer

Perfect for High-Risk

After being rejected elsewhere, BridgeSwipe finally got my account up and running. Super grateful for their support!

Jhon Watson

Quick Payouts

Funds always arrive on time, usually faster than expected. That’s a huge help for my cash flow!

Louis Ridger

FAQs

Frequently Asked Questions

BridgeSwipe is a secure payment gateway specializing in high-risk merchant accounts.

We help businesses in regulated or high-risk industries—such as CBD, nutraceuticals, online gaming, adult, and more—accept payments safely and efficiently. If traditional payment processors have declined your business, BridgeSwipe is here to help.

We focus on high-risk businesses and offer fast approvals, dedicated support, and custom risk management.

Unlike standard gateways, we have partnerships and underwriting expertise tailored to high-risk sectors, ensuring reliable service and fewer account shutdowns.

We serve a wide range of high-risk industries, including:

CBD and hemp products

Adult entertainment

Online gaming and gambling

Travel and ticketing

Nutraceuticals and supplements

Debt collection

Firearms and ammunition

If you don’t see your industry listed, contact us for a custom solution!

Simply fill out our online application with your business details, processing history, and documentation.

Our onboarding team will review your information and typically respond within 24–48 hours.

Most applications require:

Valid government-issued ID

Business license or registration documents

Recent bank statements

Processing history (if available)

Voided check or bank letter

Additional documents may be requested for certain industries.

Most accounts are approved within 1–3 business days, provided all documents are submitted promptly. Complex or high-volume businesses may take a bit longer.

Blog & News

Blog & Articles From BridgeSwipe

What is a High-Risk Payment Gateway? A Simple Guide for Business Owners….

If you’re running a business in industries like CBD, adult services, online gaming, or…

Cash on Delivery vs. Prepaid Payments: Which Is Better for Your Online Store in 2025?

In the world of online shopping, one of the most important decisions businesses face…

Top 4 Things to Look for in a Payment Gateway for Your E-Commerce Business

If you’re starting or scaling your eCommerce business, finding the right payment gateway is…