About Arland

Your Partner in Payment Innovation

At BridgeSwipe, we deliver advanced payment processing solutions built for the unique challenges of today’s businesses—especially in high-risk industries. Our services are crafted to simplify payments, maximize security, and drive greater efficiency for your operations. With deep industry expertise, our dedicated team supports you at every stage, ensuring smooth integration and outstanding performance for your business.

- Fast approval process for high-risk merchant accounts and businesses.

- Advanced fraud prevention and PCI-compliant payment security solutions.

- Seamless integration with all major eCommerce platforms and business tools.

- Transparent pricing with no hidden fees or confusing terms attached.

Key Features

Take Your Business to the Next Level

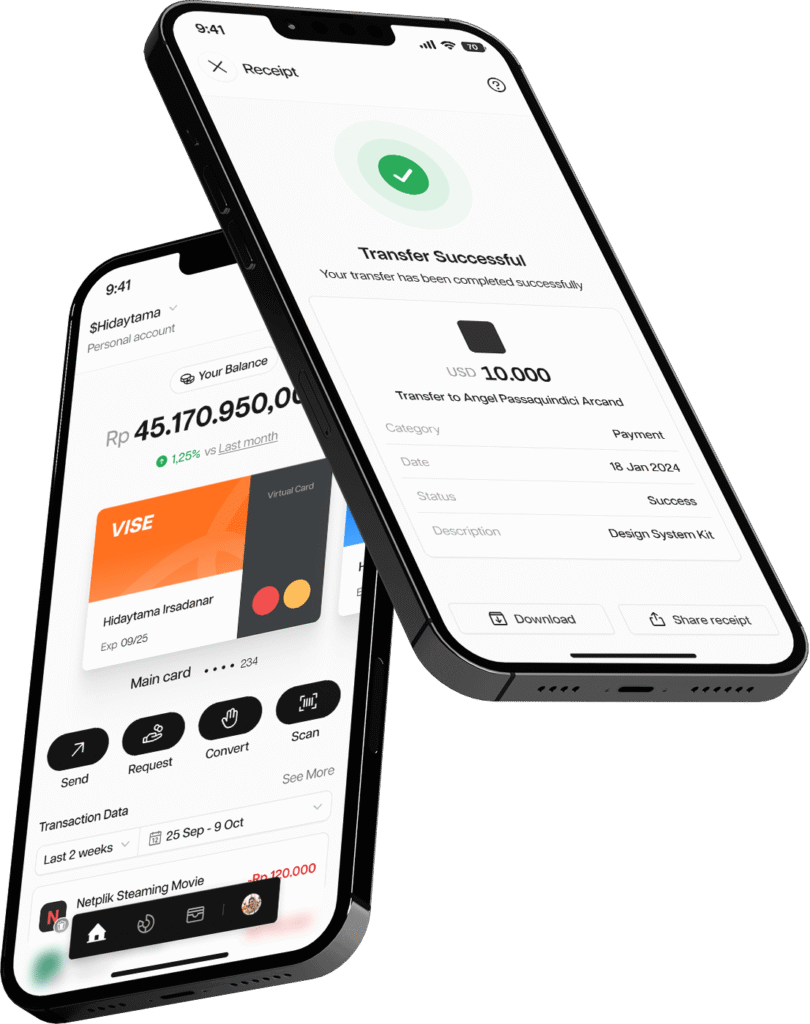

Payment Gateway

Easily accept payments online with our secure gateway. Enjoy fast transactions, advanced fraud protection, and support for all major payment methods.

Chargeback Prevention

Protect your business with smart chargeback prevention. Our solutions help detect risky transactions and minimize losses from disputes.

High Risk Merchant A/c

Get approved for high-risk merchant accounts quickly. We offer secure processing, fraud management, and expert support for your business needs.

Business Loans & Leasing

Empower your business with flexible loans and leasing options. Access quick funding to expand operations or upgrade your equipment.

International Payments

Expand globally with hassle-free international payments. Benefit from great exchange rates, low fees, and reliable transfers worldwide.

Retail Merchant Accounts

Simplify in-store payments with our retail merchant accounts. Enjoy fast settlements, secure transactions, and easy POS integration.

Vision & Mission

Ready to Start Processing with BridgeSwipe?

Join thousands of businesses who trust BridgeSwipe for their high-risk payment processing needs. Get started today and experience the difference.

Our Vision

To redefine payment processing for high-risk businesses worldwide—making every transaction simple, secure, and accessible. We envision a future where every business, regardless of industry, can operate with confidence and reach their full potential through frictionless financial solutions.

Our Mission

Our mission is to empower high-risk merchants by providing fast approvals, robust security, and transparent payment solutions tailored to their needs. We strive to remove barriers, support innovation, and build lasting partnerships—helping our clients grow without limits.

Collaborating with over 100 amazing companies from around the world

FAQs

Frequently Asked Questions

BridgeSwipe is a secure payment gateway specializing in high-risk merchant accounts.

We help businesses in regulated or high-risk industries—such as CBD, nutraceuticals, online gaming, adult, and more—accept payments safely and efficiently. If traditional payment processors have declined your business, BridgeSwipe is here to help.

We focus on high-risk businesses and offer fast approvals, dedicated support, and custom risk management.

Unlike standard gateways, we have partnerships and underwriting expertise tailored to high-risk sectors, ensuring reliable service and fewer account shutdowns.

We serve a wide range of high-risk industries, including:

CBD and hemp products

Adult entertainment

Online gaming and gambling

Travel and ticketing

Nutraceuticals and supplements

Debt collection

Firearms and ammunition

If you don’t see your industry listed, contact us for a custom solution!

Simply fill out our online application with your business details, processing history, and documentation.

Our onboarding team will review your information and typically respond within 24–48 hours.

Most applications require:

Valid government-issued ID

Business license or registration documents

Recent bank statements

Processing history (if available)

Voided check or bank letter

Additional documents may be requested for certain industries.

Most accounts are approved within 1–3 business days, provided all documents are submitted promptly. Complex or high-volume businesses may take a bit longer.